The revenue received from a service would be recorded in December when it was earned if a company provided a service to a customer in December but didn’t receive payment until January of the following year. The main difference between accrual and cash basis accounting lies in the timing of when tax deductions guide 20 popular breaks in 2021 revenue and expenses are recognized. The cash method provides an immediate recognition of revenue and expenses, while the accrual method focuses on anticipated revenue and expenses. The performance of a business is assessed more accurately due to the application of the accrual concept.

What is accrual accounting? A beginners guide

- Although it’s the more complex of the two major accounting methods, accrual accounting is considered the standard accounting practice for most organizations.

- Some of these indirect expenses may not have been paid by the end of that month, despite being accrued in that period.

- These accounts are often seen in the cases of long-term projects, milestones, and loans.

- Unearned revenues, on the other hand, are payments received before services are rendered or goods are delivered.

- In the above example, even though the amount of cash paid is different in all three cases, the rent expense recorded is $100,000 in each case.

If you’re looking for a loan or trying to attract investors, accrual accounting gives them the full picture. Lenders and investors like to see how your business is performing beyond just what’s in the bank, and accrual-based statements show exactly that. For example, your nonprofit might receive a pledge from a donor in December but not get the actual funds until March. With accrual accounting, you can record that money in December when it was promised. This gives you a much better picture of your financial situation when planning your programs, especially if you’re on a tight budget like many nonprofits are. Recording cash transactions based on when you complete services, deliver products, and incur expenses is also beneficial to your business.

Are capital expenditures treated as expenses?

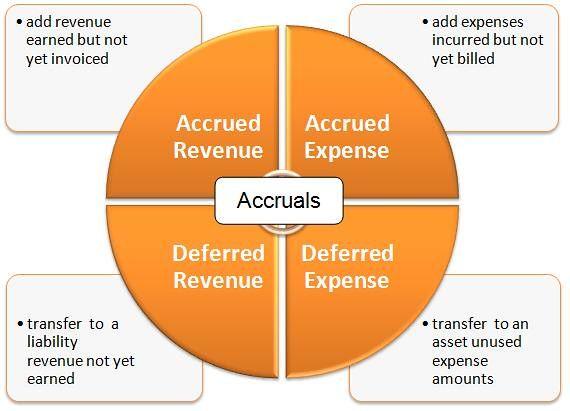

With cash accounting, the revenue generated for the service will not be recognized until cash is received on May 30th. Accruals do come with several pros and cons, but the main issue is the degree of accuracy involved. This information should always be used alongside other performance metrics to provide an accurate picture for investors. Accrued revenue and expenses can be manipulated, which means that net income may not always accurately represent how profitable a business is.

What Is the Difference Between Cash Accounting and Accrual Accounting?

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Despite its shortcomings, accruals remain a valuable and essential tool for investors, especially when used alongside other performance metrics.

According to the IRS and GAAP, you’re required to use the accrual method if your business has averaged over $26 million in annual gross receipts for the past three years. This method is also mandatory if you sell products that require inventory tracking or if your business is a C corporation or a partnership with a C corporation as a partner. Accrued revenue is any income you expect to receive for any good or service you provided. Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses. A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University.

Streamline Accrual Accounting with FreshBooks Accounting Software

Consider a scenario where an employer pays wages to its employees on the 20th day of the month for the hours they worked. In such a case, employers can accrue any additional wages earned from 21st day to the end of the month, ensuring full amount of expense on wages gets recorded in financial statements. The accrual and cash basis of accounting can both be used side-by-side as both systems have their own relevance and applicability. Since the differences between sales or revenues and expenses represent profit, owners’ equity will show an increase if profits are earned (or a decrease if losses are incurred). Comparability is the ability for financial statement users to review multiple companies’ financials side by side with the guarantee that accounting principles have been followed to the same set of standards. As mentioned above, businesses that track inventory must use accrual accounting, and retailers are no exception.

Under accrual accounting, revenue is recorded when it is earned, regardless of when it is received in cash, and expenses are recorded when a benefit from them is gained, regardless of when they are paid in cash. Also read the revenue recognition principle and the expense recognition principle. Under Accruals basis of accounting, income must be recorded in the accounting period in which it is earned. Therefore, accrued income must be recognized in the accounting period in which it arises rather than in the subsequent period in which it will be received.

When a company pays cash for a good before it is received, or for a service before it has been provided, it creates an account called prepaid expense. This account is an asset account because it shows that the company is entitled to receive a good or a service in the future. For example, let’s say a client requests a service on April 30th but does not make a cash payment until May 30th.

The applications vary slightly, but all ask for some personal background information. If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice. Our easy online enrollment form is free, and no special documentation is required. Harvard Business School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

All of this can be explained by considering the transaction that was included in the discussion on accruals. This was that Andrea agrees to buy goods from Brian on 25 January and Brian agrees that Andrea can wait until 25 March to pay for the goods. It is not necessary, and often not helpful, to simply include as much detail as possible in the financial statements. Consideration should be given to the fact that excessive detail may not actually improve presentation and therefore not assist users of financial statements.